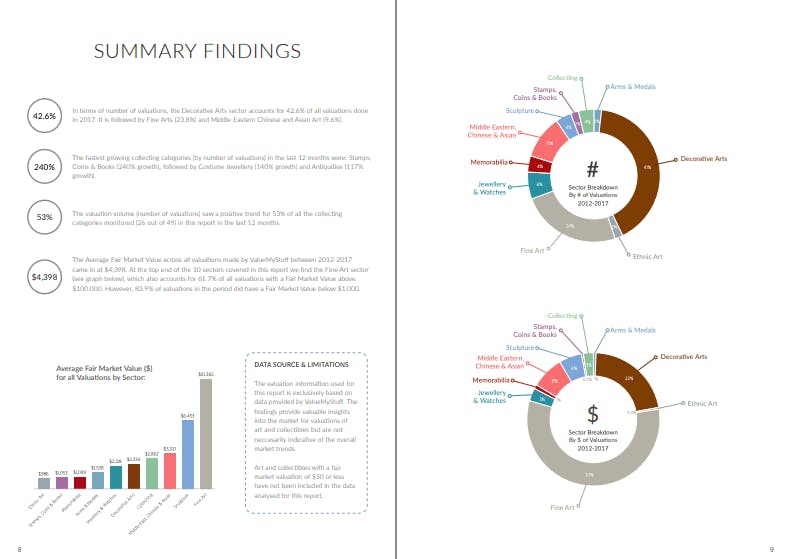

Valuations & Appraisals Market Report

The ArtTactic Valuations Report: 2018

Whilst ValueMyStuff has been actively providing valuations directly for our online clients, we have now launched our new product which in my view will be a game changer for our business and hopefully the industry. We can now provide our online valuation services, with 48 hour turnaround, for other businesses under their brand. This means that the technology we have built with human input from our experts can be used by auction houses, insurance companies and many other businesses. Having a client and providing a valuation for their watch, painting, classic car, then enables those businesses to sell on the back of the valuation, insurance services online, or borrow against those assets etc… I predict we will see many different applications and other business models emerge, with always the valuation of the object as a starting funnel for that customer journey. As I am writing this, it is late January, and we already have 18 businesses signed up to use our valuation services under their brand (so their own customers wont even know it is ValueMyStuff doing these valuations). The majority of these businesses so far are auction houses. This enables them to further build in efficiencies into their auction house. If all enquiries and valuations that come in online are properly logged, sorted, categorised are dealt with within 48 hours, their managers can login once a week and check how many valuations came in online, how many are above a certain value etc and for the first time, they will be fully equipped to have a clear view on what their online funnel looks like, with breakdowns per category, per value, per country, etc… For the first time many of these businesses will have a proper, clear cut view of what their online valuation world can bring to their business. This is the next chapter of your business, and one I am tremendously excited about.

Thank you for taking the time to read this report and I hope you will enjoy going through our findings as much as we did.

The Art market is not just about selling and buying...

...it is also about Valuing Art and Appraising Art.

Art as an Asset Class

Over the last decade we have experienced an increasing interest in art as an asset class. Deloitte and ArtTactic have carefully monitored this development since the first issue of the Art & Finance Report was launched in 2011, and with the 5th edition of the report published in November 2017, a number of issues remain critical to the future of art as an asset class.

One recurring theme discussed in these research reports is the importance of valuations in the development of the art and finance industry. Below I have outlined a few important trends from the Art & Finance Report 2017 that I believe could have a direct impact on the valuation of art and collectibles in the future.

Art Insurance

At the most basic level, the difference between an insurance valuation and an auction valuation is that the latter reflects the reasonable estimate to entice bidding from either trade buyers or private individuals, and of course net of the auction house’s buyer’s premium. Hence insurance valuations have traditionally been up to around 150% of high auction estimates. This is to reflect the fact that if an item is lost, stolen or has suffered damage that cannot be restored, the insured will potentially have to pay considerably more than the auction estimate to find a similar ‘replacement’ item available in the retail market. Many insurers, and indeed other art market professionals, will also often refer to fair market value, generally defined as:

The price at which an item would sell on the open market between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts.

All too often, collectors will simply accept the notion of ‘insurance value’ without questioning whether it really represents the right protection for them, and for which they want to pay. Most insurers will assess premiums as a percentage of the insured value. Hence, generally speaking, the greater the value at which an object is insured, the higher the premium that will be payable. Clarity is key and it is important, whether a business, museum, trust or private collector, that the basis on which artworks and collectibles are to be insured is discussed with an insurance broker and clearly represented in the insurance policy agreed by the underwriter.

Art Lending

financial institutions wishing to engage in art lending. According the Deloitte/ArtTactic Art & Finance Report 2017, 73% of market respondents cite valuation (or lack of mark-tomarket valuation) as the main hurdle to offering art-secured lending to clients. Indeed, heterogeneous, characteristicdriven, generally illiquid property, such as artwork, presents particular (but not insurmountable) challenges to valuation. But as the art market expands in terms of activity, collector interest and capital allocation, the incentives for more systematic, data-driven approaches to art valuation continue to grow.

From the art lender’s perspective, prudent collateral valuation, together with the advance rate (or loan-to-value or LTV), are fundamental risk management tools that allow a lender to safeguard capital, while supplying liquidity to the market. In general, the lender’s approach to valuation is dictated to a large degree by their business model. The more the art collateral alone serves as the primary source of loan repayment, the greater importance the valuation process takes on - as is the case for Athena Art Finance as an independent, non-bank art lender. By contrast, private bank art lenders that view art as a secondary (or even tertiary) source of loan repayment, instead relying on a client’s overall balance sheet or “relationship” may tolerate a comparatively higher margin for error in the art valuation process.

Value Trends

As the art market has transformed radically over the past 20 to 30 years, so the valuations business has adapted to the new hierarchies of value and a world where the technological boom has created a huge availability of information. In the early 1980s, the valuations business was relatively straight forward; regular auctions and consistent prices made for a fairly simple process, and the largest valuations usually involved country houses and private collections often filled with important Old Masters and works of art. The landscape today is remarkably different; art is increasingly treated as an investment, values move faster, there’s an abundance of pricing information, and the majority of our most valuable valuations are in modern and contemporary art.

It’s important to note that there has always been an interesting relationship between sale prices and valuations. While art and antiques which are sold seem to have an obvious and immediate value at a given point in time, there is often a need to assign values for a host of reasons, including probate and insurance, and for objects which might be unique, or which might not have been sold for decades or centuries. In today’s market, valuations also play a key part in the mechanics of ‘art finance’ which is increasingly prominent. And while the most influential information when assigning a value is recent and historic prices, the application of a value also requires a significant level of intuition and expertise. For example, in undertaking a museum valuation, one cannot rely on saleroom prices alone to value works of art which rarely, if ever, appear for sale.

Twice as many artworks get valued compared to being sold,

so the art valuations & appraisals market is huge.

Standardisation

Without knowing exactly what the future may bring, one can assume that today’s global art market will continue to penetrate the far corners of the world. We now have an enhanced ability to communicate ideas, share experiences and to learn from how others have managed their collections. With prices for art objects at their heights, planning on what to do with acquisitions comes into play. Some collect art as an investment, intending to bring their art back to market in 5, 10, or 20 years, hoping for greater gains from the date of purchase. Other collectors may wish to pass their acquisitions on to their heirs to keep it within their families’ holdings, or still others plan to make donations to a museum to ensure appropriate care and accessibility for the public to appreciate.

At the time when any one of these events takes place, the seller, decedent or donor will want to have a value placed on their art. Many countries place a capital gains tax on works sold, levy an estate tax when the owner passes and/or grants a tax credit when a donation of art is made. All of these scenarios require that a value be placed on the object at the time that one begins this new transaction.

Advisory

People need to define the “value” of an artwork for many purposes: insurance, probate, auctions, private treaty buying and selling. These values are not the same. Partly, this is because of the function of the price: auctioneers may require the lowest estimate they can justify to draw people into a bidding war, while insurers want to be certain that you can replace that work of art with something similar in the retail market. But this variance reveals a truth at the heart of valuing art: nearly all values are someone’s best guess.

For the art adviser, this inexactitude around a work of art is part of working life. If an art adviser is working with a certain genre or artist there might be the added complication of a very volatile market (as with all markets, bubbles can rise and cause sudden shifts in value) which only adds to the imprecision. A good art adviser will be aware of this economic context and it us up to the adviser to manage client expectations and to navigate their way through this landscape.

Blockchain Technology

Over the last few months, there has been a lot of talk surrounding the application of blockchain technology in the art world and the opportunities that it presents us with. As an industry where change and adaptation are key, more so now than ever before, we explore what blockchain will do for us.

So, what is blockchain technology? By allowing digital information to be distributed, but not copied, blockchain technology has created the backbone of more efficient and secure data recording. Originally created for digital currencies, such as Bitcoin, other applications of the technology are being explored at a rapid rate. One such industry feeling these effects is the art world.

Is blockchain truly applicable in the art world? Yes, in many ways. One such example is through an incorruptible digital ledger or ‘stamp’, being firmly attached to artworks. One singular item at one moment in time, with specific descriptions and cataloguing, attached to a ledger, which is securely stored and cannot be changed thereafter.